The past week delivered a clear, if sometimes conflicting, message about the future of digital currency: the focus has definitively moved from token speculation to infrastructure and compliance. Governments, central banks, and major financial institutions are actively shaping the emerging stablecoin regulatory framework, signaling that these digital assets are no longer a fringe element. This strategic shift underscores the growing recognition of stablecoins as a core component of the global payment system.

One of the most significant pieces of news came from the United Kingdom. The Bank of England (BoE) published a consultation paper detailing a proposed regulatory regime for sterling-denominated systemic stablecoins. The proposal outlines a framework for digital money that could be widely used for retail payments and wholesale financial settlements. Crucially, the BoE paper included a plan for temporary holding limits—specifically £20,000 for individuals and £10 million for businesses. These limits, designed to manage systemic risk as the financial system adapts, highlight the seriousness with which central banks view the potential impact of stablecoins on traditional bank deposits and monetary policy. This regulatory move, which aims to keep pace with US legislation like the GENIUS Act, shows a global coordination in establishing a secure stablecoin regulatory framework.

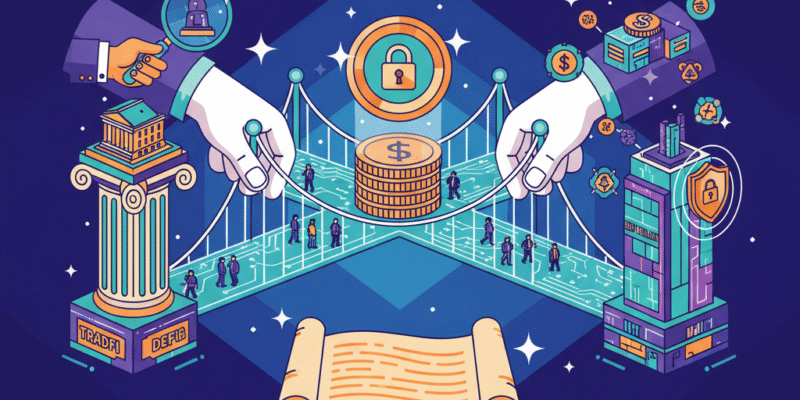

Simultaneously, traditional financial institutions (TradFi) are accelerating their embrace of the sector, providing much-needed infrastructure. BNY Mellon, one of the world’s premier custody banks, announced the launch of the BNY Dreyfus Stablecoin Reserves Fund (BSRXX). This dedicated government money market fund is explicitly designed to hold the reserve assets for stablecoin issuers. This provides a compliant, highly regulated, and transparent method for managing collateral, bridging the trust gap between digital assets and institutional finance. Anchorage Digital, the first federally chartered crypto bank in the U.S., has already backed the fund, demonstrating institutional appetite for this new, secure stablecoin infrastructure.

Furthermore, the impact of the U.S. GENIUS Act continues to be discussed at the highest levels. The Federal Reserve, referencing the Act, noted that it provides a clear regulatory pathway for issuers to broaden their reach, solidifying stablecoins as a core part of the payment system. The Act and the subsequent regulatory conversations like the ongoing debate over whether stablecoin issuers should be permitted to pay interest are actively determining the future nature and scope of the stablecoin market. The growth and stability of the entire ecosystem are now fundamentally tied to the success of this emerging stablecoin regulatory framework. These combined actions from central banks and global financial giants confirm that stablecoins have graduated from a crypto experiment to a permanent and regulated feature of the global economy.

Comments